خبير العطور a Twitteren: "شيروتي 1881 من أشهر عطور النظافة النسائية القديمة جربته ثباته متوسط ولاتحس إنك تحط عطر بس إللي حولك بيسئوولنك عنه http://t.co/Bbog2et6sG" / Twitter

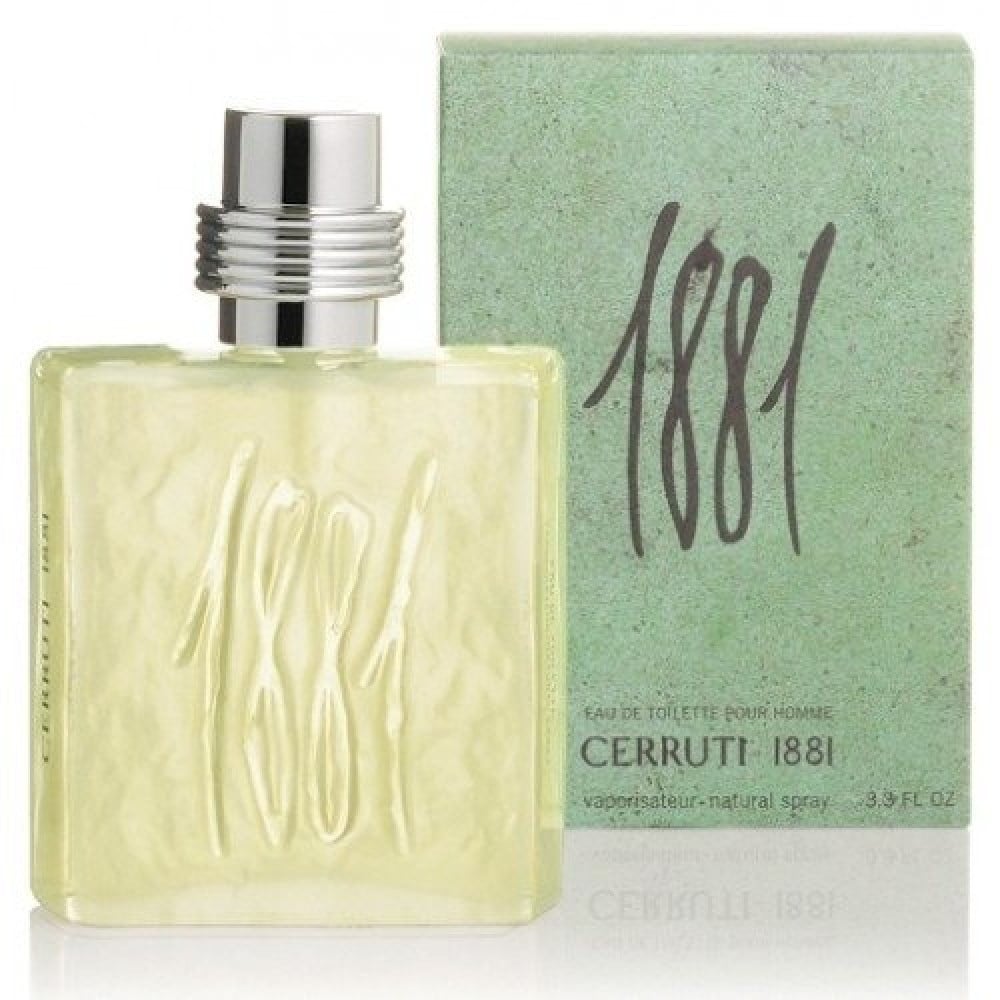

عطر شيروتي 1881 فير بلاي الرجالي او دو تواليت 50مل - متجر اصفهان العطور - افضل متجر عطور ات اصلية اون لاين في السعودية

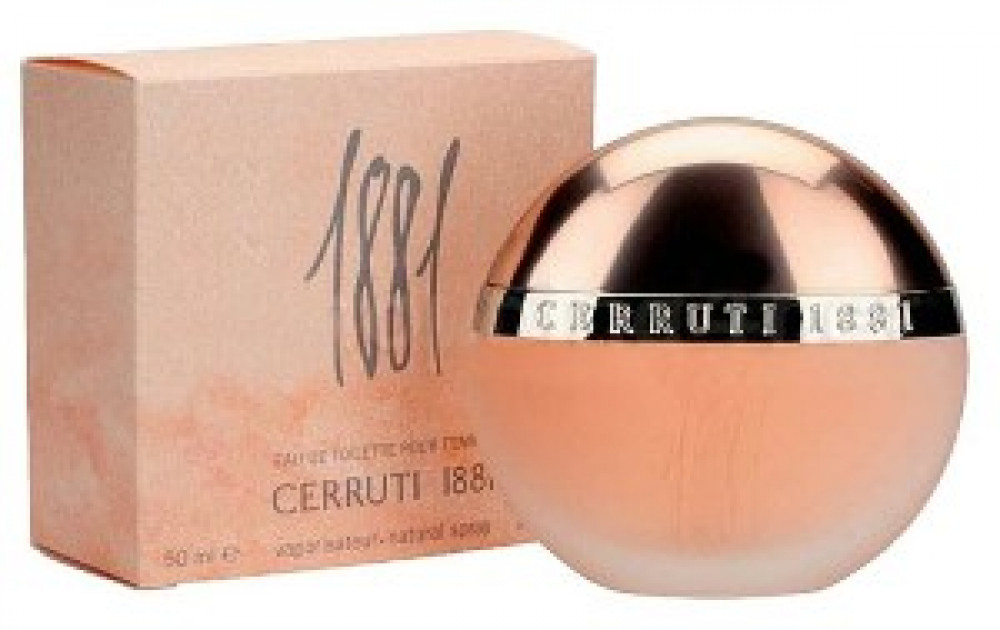

اشترِ عطر سيروتي 1881 للنساء أو دي تواليت 100 مل عبر الإنترنت في الإمارات العربية المتحدة | شرف دي جي

عطر دونا كاراعطر شيروتي 1881 النسائي او دو تواليت 50ملن دكني بي ديليشس فريش بلوسوم سباركلينج ابل او دو بارفيوم 50مل - متجر لوتانا ستور

عطر شيروتي 1881 اسنشيال الرجالي او دو تواليت 100مل - حنان العطور - افضل متجر عطور اون لاين الكتروني سعودي

![شيروتي 1881 او دي تواليت للنساء [50 مل]: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية شيروتي 1881 او دي تواليت للنساء [50 مل]: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية](https://m.media-amazon.com/images/I/51KwIdOHsbL._AC_UF1000,1000_QL80_.jpg)

شيروتي 1881 او دي تواليت للنساء [50 مل]: اشتري اون لاين بأفضل الاسعار في السعودية - سوق.كوم الان اصبحت امازون السعودية